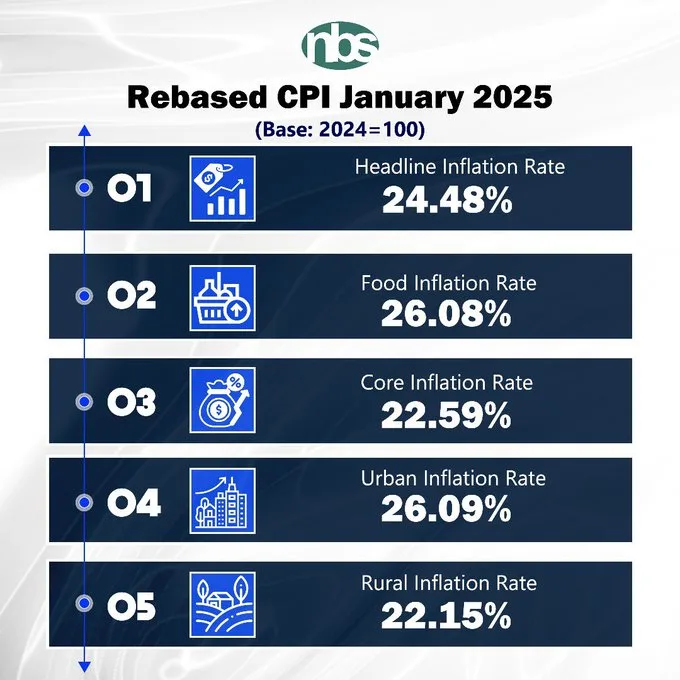

Nigeria’s headline inflation has dropped significantly to 24.48% year-on-year in January 2025, marking a sharp decrease from the 34.80% recorded in December 2024.

This data, released by the National Bureau of Statistics (NBS), was announced by the Statistician-General of the Federation, Adeyemi Adeniran, during a briefing on Tuesday. Adeniran explained that the Consumer Price Index (CPI), which tracks the rate of change in the prices of goods and services, declined to 24.48% in January compared to the previous month.

Breaking down the inflation rates, Adeniran shared that urban inflation stood at 26.09%, while rural inflation was recorded at 22.15%. These figures represent a notable reduction in the general price level across the country, reflecting the changes made to the CPI template. The re-basing of the CPI, which aligns with international standards, aims to ensure that inflation data accurately reflects current consumer spending patterns and economic conditions.

Re-basing the CPI involves updating the reference year used to calculate price changes, ensuring it better mirrors current consumption trends. As part of the adjustments, food inflation, based on the new CPI, decreased to 26.08% year-on-year in January, down from 39.84% in December 2024.

Similarly, the rebased core inflation index, which excludes volatile agricultural prices and energy costs, stood at 22.59% year-on-year in January.

Adeniran emphasized that the updated CPI reflects both current inflationary pressures and shifts in consumer behavior, giving a more accurate picture of the country’s economic landscape.

Earlier in the month, the Governor of the Central Bank of Nigeria (CBN), Yemi Cardoso, reaffirmed the bank’s commitment to reducing inflation and stabilizing the economy. During the 2025 Monetary Policy Forum in Abuja, Cardoso stated, “Managing disinflation amidst persistent shocks requires robust policies and coordination between fiscal and monetary authorities to anchor expectations and maintain investor confidence.”

He added, “Our focus must remain on price stability, transitioning to an inflation-targeting framework, and implementing strategies to restore purchasing power and alleviate economic hardship.”