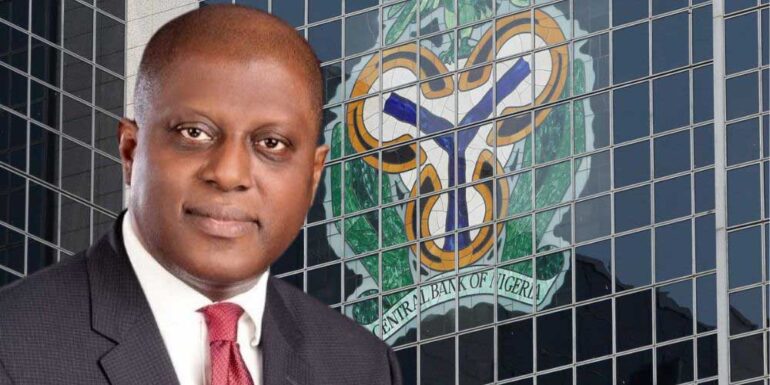

Nigeria’s foreign reserves have risen to over $46 billion, marking their highest level since 2018, the Governor of the Central Bank of Nigeria (CBN), Yemi Cardoso, announced on Monday.

Cardoso, represented by the Deputy Governor in charge of the Economic Policy Directorate, Dr. Muhammad Abdullahi, disclosed this at the opening of the Monetary Policy Department’s 20th Anniversary Colloquium at the CBN headquarters in Abuja.

He said the current reserve level is strong enough to cover more than 10 months of imports, signalling improved external stability.

Abdullahi also hinted that lending rates may begin to ease in the coming months as inflation continues to moderate, a development he said could enhance access to credit and boost investment flows.

Meanwhile, CBN data showed the naira depreciated marginally by 0.4% on Monday, trading at ₦1,448.03/$ at the Nigerian Foreign Exchange Market (NFEM), compared with ₦1,442.43/$ on Friday. In the parallel market, however, the naira appreciated slightly, closing at ₦1,455/$, up from ₦1,457/$ recorded on Friday.

Nigeria’s external reserves now at $46.7 billion have been buoyed by the federal government’s recent Eurobond issuance and rising foreign exchange inflows.

October 2025 recorded the strongest FX inflows since May, driven by renewed investor confidence and improved macroeconomic conditions in Africa’s largest economy.

Despite this progress, Foreign Direct Investment (FDI) fell by 25% month-on-month to $222 million, reflecting persistent structural challenges including insecurity and policy uncertainty that continue to discourage long-term investment.