The Central Bank of Nigeria (CBN) has raised its Monetary Policy Rate (MPR) to 27.50%, up from 27.25%, in an effort to tackle rising inflation. The decision followed the latest meeting of the CBN’s Monetary Policy Committee (MPC), which met on Tuesday at the bank’s headquarters in Abuja.

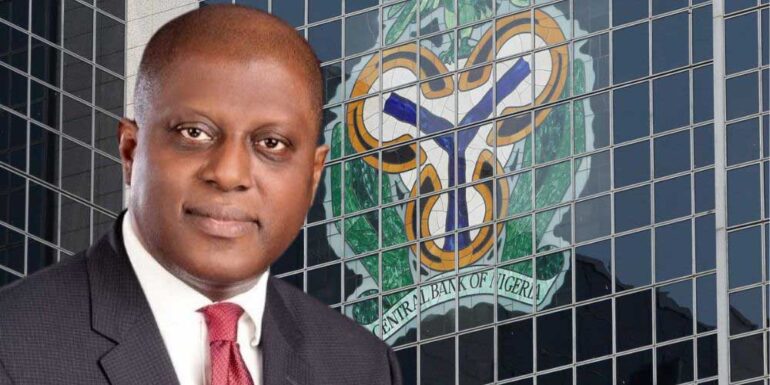

CBN Governor Yemi Cardoso made the announcement, stating that the MPC voted unanimously to increase the MPR by 25 basis points. The Committee also decided to maintain the Cash Reserve Ratio (CRR) at 50% for Deposit Money Banks and 16% for Merchant Banks.

“The Committee was in full agreement to raise the MPR by 25 basis points to 27.50%,” Cardoso said, adding that the Liquidity Ratio (LR) would remain unchanged at 30%, and the Asymmetric Corridor would be retained at +500/-100 basis points around the MPR.

The decision comes in response to renewed inflationary pressures, as both headline and core inflation measures increased year-on-year in October 2024. “The Committee’s considerations were based on the ongoing inflationary challenges, with food and core inflation rising sharply in October,” Cardoso explained.

This marks the sixth interest rate hike by the CBN since February 2024. In September, the bank had raised the MPR to 27.25% after inflation showed signs of easing. However, the National Bureau of Statistics (NBS) reported earlier this month that Nigeria’s inflation rate surged to 33.88% in October, up from 32.7% in September. This represents a 1.18 percentage point increase from the previous month.

The NBS attributed the spike in inflation to higher transportation costs and rising food prices, which have been contributing factors to the persistent inflationary pressures. On a year-on-year basis, the headline inflation rate in October 2024 was 6.55 percentage points higher than the 27.33% recorded in October 2023.

The CBN’s latest rate hike reflects its ongoing efforts to control inflation and stabilize the economy amidst persistent price increases.